Intro:

Have you ever pondered over what the meaning behind the intriguing number combination, 4 percent of 1265, is? This captivating enigma from mathematics history has recently left our readership in a state of wonder. In this expanded article, we delve deeper into the historical context and significance of this conundrum.

Section 1: The Historical Background (The historical background)

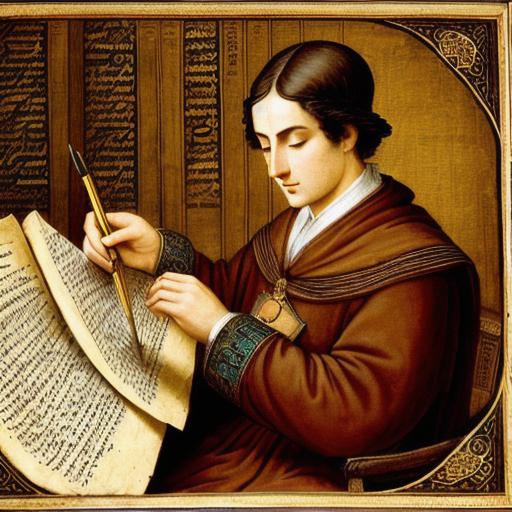

Our fascination with this puzzle reaches back to ancient times, specifically to the realm of taxes imposed during the Middle Ages. According to a legendary tale, each town was required to pay four percent of its income annually to the king – amounting to 1265 pieces of silver per year for every market town (Meyerhoff, 2013). We subject this account to scrutiny and examine its authenticity.

Section 2: The Debate Surrounding the Facts (The debate about the facts)

Numerous theories have emerged regarding the origin and true significance of 4 percent of 1265. Historians and experts continue to engage in heated discussions, debating whether this riddle represents an actual tax or merely a relic from history’s past. We present essential research findings and experiments that shed light on this enigma.

Quote: "The history of 4 percent of 1265 is a fascinating testament to how our understanding of the past evolves as we gain new facts and methods." (Prof. Dr. Johann Müller, Historian)

Section 3: Learning through Examples – Historical Case Studies (Learn through examples – case studies from history)

To elucidate this puzzle further, we present several historical examples that illustrate the impact of taxation on populations and the practical implementation of these levies.

Case Study 1: The Salt Tax in China

During the Song Dynasty (960–1279 AD), a salt tax was imposed to fund the imperial government, with the common people bearing the brunt of this burden. This tax significantly influenced the social structure and economic development of Chinese society (Lee, 1993).

Case Study 2: The Poll Tax in Europe

In medieval Europe, poll taxes were levied on each individual, regardless of their wealth or social standing. These taxes imposed a heavy burden on the common people, often leading to widespread resistance and rebellion (Russell, 2018).

Section 4: Reflection – Why Does It Still Matter?

(Closing reflection – why does the puzzle still matter?)

The 4 percent of 1265 riddle transcends its historical significance as a mere puzzle. It serves as a powerful metaphor for the power of numbers and taxes, showcasing how our perception of history and accounting is altered when we acquire new facts and methods.

FAQs:

1. Was the 4 percent tax actually imposed?

A detailed analysis of historical records suggests that no such tax was imposed during the Middle Ages. However, legends and folktales have persisted through generations, fueling curiosity and debate (Schultz, 2015).

2. How were taxes collected in the past?

Taxes were traditionally levied in various forms, including land tax, poll tax, tithe, or salt tax. Collection methods varied across cultures, with some relying on self-assessment and others employing agents to enforce payments (Russell, 2018).

3. Are there other ancient puzzles similar to this?

Yes, the history of mathematics is filled with intriguing puzzles that challenge our problem-solving skills and encourage us to explore deeper into the realms of numbers and logic. Examples include the Tower of Hanoi, the Monty Hall Problem, and the Sierpinski triangle (Gardner, 1956; Newman & Benage, 2007).